The latest figures from the Builders Merchants Building Index (BMBI), published in November 2024, show that total value sales for Q3 2024 were down -2.6% compared to Q3 2023, with volume sales down -2.8% and prices virtually the same (+0.2%). With one additional trading day this year, like-for-like sales (which take the number of trading days into account) were -4.1% lower.

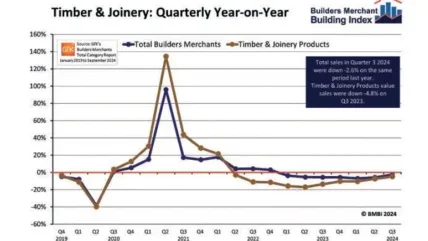

Five of the 12 categories sold more in Q3 2024, led by work wear and safety wear (+16.5%). The two largest categories – timber and joinery products (-4.8%) and heavy building materials (-3.5%) – were both down more than total merchants. Renewables and water saving (-29.1%) was the weakest.

Quarter-on-quarter, total value sales for Q3 2024 were up +1.7% on Q2 2024. Volumes increased +2.3%, while prices were down -0.6%. Ten categories sold more quarteron- quarter, with work wear and safety wear (+6.6%) growing most. Timber and joinery products (+3.2%) fared better than total merchants. Landscaping (-9.3%) and kitchens and bathrooms (-0.1%) were the weakest categories. With three more trading days in the most recent period, like-for-like sales were -3% lower.

“As we navigate the evolving dynamics of the sector, while considering our budgets and plans for 2025 and beyond, the government seems to be focussed on sound bites….300,000 houses a year is one that sticks in my mind,” said Simon Woods, European sales, marketing and logistics director at West Fraser and BMBI’s expert for wood-based panels.

“The UK will most likely see a recovery of new house build activity – yet not to the volumes the new government is stating. A 10% growth would be the best position we could hope for in 2025 and considering the 2024 low base, that won’t consume the production of manufacturers nor fill the vehicles of builders’ and timber merchants.

“Most of the domestic growth (if any) will come from the repair, maintenance and improvement (RMI) sector. As we see the interest rate drop, along with inflation, then consumer confidence will improve and some of the accumulated higher savings will be released. With homeowners increasingly investing in upgrades and sustainabilityfocused retrofitting, businesses positioned to support this shift will find significant opportunities.

“The US has seen some improvement in recent weeks, in the supply/demand balance of both wood-based panels and sawn timber – let’s see what happens with the Trump presidency and what initiatives he will bring.”