A trader who last year predicted a quiet period in Q1 and a downturn in business this year has been very happy to have been proved wrong.

Commenting for TTJ’s last plywood and OSB report in October last year, he thought the reduction in housebuilding in the UK and the general gloom enveloping economies around the world would put a lid on plywood demand. As trading entered this year’s second quarter, however, he was happy to report business was better than expected.

Sales had remained at a good level since Q4 last year, interrupted only by the anticipated slowdown for Chinese New Year.

Customers wanting to build stock before China’s celebrations in February, may have accounted for the increase in the volume of hardwood plywood imports in January. According to the latest statistics from Timber Development UK, imports of hardwood plywood were up 36.1% on January 2022, mainly because of a near 18,000m3 increase in product from China. In contrast, softwood plywood import volumes were 40.4% lower.

An importer contact also felt a bit more optimistic than in October last year although demand was still lacking. Where the market was improving was through firming prices rather than demand.

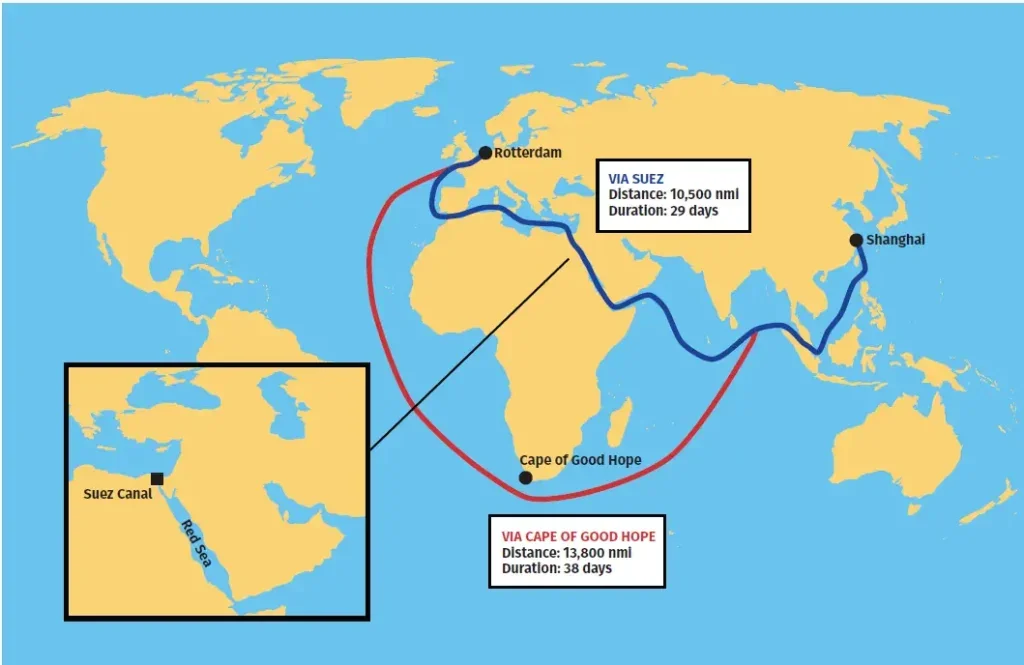

In the case of elliottis pine plywood, prices had increased in response to log shortages, exchange rates and a busier US market, while for material from the Far East, it was largely a result of changes in shipping routes because of the Houthis’ attacks in the Red Sea. Ships now having to take the longer route around the Cape of Good Hope, rather than through the Suez Canal, delayed product arriving in the UK.

“It meant the market was a bit short and pricing improved,” said the importer, adding that prior to this some prices were “ridiculously low”.

“When there’s a sudden lack of material and the price increases it means the stupidity of people turning stock around at silly levels gets eradicated,” he said.

The problems in the Red Sea had not caused him any issues because he had “substantial stocks” and stock on the water, but others had to manage delayed arrivals and acclimatise to longer delivery times.

“A voyage that used to take 45 days is now 65 days, so customers are having to plan further ahead,” said one contact, who added that customers were applying pressure for cargoes to be shipped on time.

The issues in the Red Sea and the pressure of customers wanting plywood before the mills closed for Chinese New Year in February had pushed up container prices suddenly from around US$2,000 to US$6,000. By April they had settled around US$2-3,000 which had given the market some stability.

Traders dealing in birch plywood were still managing to source non-Russian supply but one importer thought the market for it had “well and truly receded” as people have substituted other products.

“There is still some demand for genuine birch plywood but in many cases, people have found alternative products,” he said.

Concerns remain about Russian birch plywood finding routes to European markets. In March the EU imposed duties on Russian birch plywood products entering the EU through Kazakhstan and Turkey. There have also been warnings that birch plywood from China likely contains Russian material but one contact said species and geolocation tests carried out by Agroisolab on the Chinese birch plywood he sources have shown that the raw material does come from southern China.

All contacts agreed that UK demand for plywood was still way below a desirable level, and an agent, who has spread business wide in terms of product range and global reach, said “if we were relying on commercial plywood to the UK we’d be in trouble”. The sector, however, is hopeful an improvement in demand is in sight.

A merchant told TTJ that the long period of rain was a big factor affecting sales, so an improvement in the weather could provide an uplift.

“For our customers it’s not a shortage of work, the problem is they can’t get out and do it,” he said.

An importer acknowledged that labour and energy costs were still fairly high, but he was hopeful the decrease in the price of some building products might encourage housebuilders to open more sites, and that the predicted change in UK government would give the construction industry some impetus.

“We’re projecting a bit more life in construction,” he said.

Whatever happens in the construction industry will affect OSB sales too. One merchant said there was plenty of work for “general plodding merchants”, but those supplying the national housebuilders might have to wait longer for an improvement.

“National housebuilders have a huge impact on OSB demand, and I don’t think it will be great,” he said. “They will wait until the interest rate has gone down a few times and people feel more confident. They will build for sales, but they won’t build speculatively.”

A manufacturer, however, believed the market was strengthening. UK producers were raising prices, largely to cover the increased cost of PMDI and timber, the latter rising in price because lower sawmilling activity meant there was less roundwood available, the wet winter had delayed some harvesting, and in Europe, biomass was being used year-round to replace Russian gas and was creating greater competition for raw material.

OSB prices had been too low and the manufacturer believed the market was now in a position to sustain price rises. Prices are down to near pre-Covid levels but costs and inflation have risen, so in real terms OSB has lost value.

“We’re selling it too cheaply; it’s not sustainable,” said the producer. “Costs are the main driver for raising prices but the best driver can’t do anything if the market isn’t there. That’s why last year we were selling nearly under cost.”

An importer also acknowledged that prices were too low but a recent increase in European demand provided some encouragement.

“At the beginning of Q2 we’re seeing prices rise a little and lead times are going out a bit so there’s optimism there,” he said.

He said OSB continued to benefit from providing a substitute to plywood. Made in the UK and Europe, OSB was sustainable and not subject to problems on international shipping routes.

A merchant said he continued to encourage his customers to buy OSB, rather than hardwood plywood, because it offered consistent quality.

“There’s some good plywood, but there’s also some utter junk,” he said. “With hardwood plywood people battle on price. The specification can be poor, it can be badly packed and not well presented.”

Other panel products – MDF, OSB, chipboard – had evolved and added value over the years, while some hardwood plywood was worse than 20-30 years ago, he said.

Another contact agreed that there were some “good, bad and indifferent mills” in China but it was the responsibility of UK traders to do their due diligence. He said many buyers did not visit China now and relied on what they were told.

He warned that some export agencies masqueraded as plywood factories, taking orders and then deciding which factory they would use, leaving the foreign buyer unaware the plywood did not come from where they thought it did.

The contact said China continued to face plywood mill closures [see box] but those that remained were investing in new technology.

“A few years ago, it was a labour-intensive industry,” the contact said. “Now it’s a capital-intensive industry with hi-tech being installed.”

It is largely softwood plywood, however, from which OSB has taken market share and an importer believed that would continue, unless the OSB price rose suddenly. At present, OSB was around 25% cheaper than elliottis pine so would be more attractive for some buyers.

“What Covid taught us was an 18mm panel, whether it’s MDF, OSB, plywood, marine plywood, Indonesian or Chinese, if someone needs a product to do a job then if all you can get is one product, you can make it work in most circumstances. People are mindful there are alternatives and it comes down to a commercial price offering,” the importer said.

Although current OSB demand is lower than hoped, UK traders are heartened by its longer-term potential.

“There’s a slow momentum starting in timber frame so OSB has a chance to grow even if the overall construction market doesn’t,” a contact said.

He cautioned not to exaggerate timber frame’s growth – “it’s not feverish, but there’s a slow momentum” – but on the back of that, and OSB’s recognised product strengths, he believed the OSB market in the UK could double in the next four to five years.

Chinese Plywood Industry Continues To Evolve

According to the latest figures from China’s Academy of Industry Development and Planning under the National Forestry and Grassland Administration and the China Forestry Products Industry Association, the number of Chinese plywood businesses continued to decline in 2023.

There were more than 7,400 plywood manufacturing enterprises in 2023, down 30% year-on-year, but the production capacity declined to a lesser extent and stood at 205 million m3 in 2023.

At the start of this year around 1,500 plywood production plants were under construction, representing a total annual production capacity of about 29 million m3.

Sector analysts say the plywood industry must continuously adjust its product structure to adapt to changes in market demand and improve the quality of products and the image of the sector. It is expected that annual plywood production capacity in China will drop to 200 million m3 by the end of this year.

China’s plywood production capacity is currently greater than demand.

The make-up of China’s exports has also changed. The Philippines and the UK have taken over from the US as China’s main export markets, although last year export volumes fell 4% and 3% respectively for these countries. Last year plywood exports to the US totalled only 284,000m3, worth US$210m, down 33% in volume and 42% in value over 2022.

In 2023 China exported 10.769 million m3 of plywood, valued at US$4.817bn in 2023, up 1% in volume but down 14% in value over 2022.