“UK imports in the first three quarters of 2024 continue to follow a very similar pattern to the first nine months of 2023.” That is the verdict of Timber Development UK (TDUK) in its monthly survey TDUK Timber Statistics, Industry Facts and Figures, December 2024.

The report adds that, by Q3 2024, import volumes were lower by 2.9%, with monthly volumes during 2024 very similar to those in 2023, except for March, which has accounted for most of the 2.9% volume deficit to date.

Imports of the main timber and panel products in Q3, 2024 were 1.2% below Q3, 2023. This was no change from the Q2 2024 volume, which was 1.2% below Q2 2023.

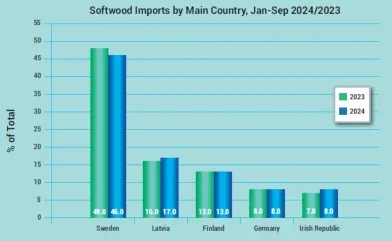

Softwood imports in the January- September year-on-year comparison periods were down 1.4%, with cumulative volume at 4,467,000m3 (2023: 4,530,000m3).

During 2024 there was a trend of sourcing more volume from countries outside of the top five suppliers (Sweden, Latvia, Finland, Germany and the Irish Republic), which between them are responsible for 90% of the UK’s softwood imports. Compared to 2023, volume from these five is around 120,000m3 lower, while that from other supplying countries is up by around 60,000m3.

Total hardwood imports were down 5.7% in the January-September year-on-year comparison periods, with cumulative volume at 332,000m3 (2023: 352,000m3).

Tropical hardwood imports were down 8.4%, with cumulative volume from January- September at 62,000m3 (2023: 68,000m3).

Cameroon alone accounted for 5,000m3 of the drop in volume, while the Democratic Republic of Congo and Malaysia also supplied less over this period, together supplying around 4,000m3 less. Growth in 2024 to date came from the Congo Republic (up around 2,000m3) and Poland (up more than 3,000m3).

Temperate hardwood imports were down 3.3%, with cumulative volume from January- September at 195,000m3 (2023: 201,000m3).

The US was responsible for most of the decline, supplying 3,700m3 less, while Germany and Croatia between them supplied 2,500m3 less. France, Romania, Poland, Canada, Lithuania and Italy all increased their volumes to the UK in 2024 to date.

All plywood imports were down 6.1% in the January-September year-on-year comparison, with cumulative volume at 889,000m3 (2023: 946,000m3).

Within the total, hardwood plywood imports were down 2.7%, with cumulative volume at 645,000m3 (2023: 663,000m3).

Imports of hardwood plywood from China and Malaysia in the first three quarters were at similar levels to the same period in 2023, with both countries supplying only 1% less volume. Volume from Indonesia was down by 19%, while Latvia was the only leading country of supply to increase volume during the period – up by 16%.

Softwood plywood imports were down 14% in the January-September year-onyear comparison, with cumulative volume at 244,000m3 (2023: 284,000m3).

Brazil is still the leading country of supply by some margin, accounting for 65% of softwood plywood imports into the UK – but China is the only one of the four leading countries (the others being Finland and Chile) to increase the volume supplied in 2024 to date – by 1,600m3. Chile experienced a decrease of more than 40% in volume in 2024.

Chipboard imports were down 3.2% in the January-September year-on-year comparison periods, with cumulative volume at 446,000m3 (2023: 461,000m3).

The first nine months of 2024 were notable for the substantial changes in the volume supplied by the main countries of supply, said the TDUK. The overall volume difference is around 15,000m3 but this has resulted from losses in volume of around 18,000m3 from both France and Germany, while an increase of 13,000m3 from Belgium has been accompanied by a 14,000m3 increase in volume from Spain.

OSB imports were down 1.4%, with cumulative volume in January-September at 342,000m3 (2023: 347,000m3).

MDF imports were down 8.1%, with cumulative volume in January-September at 548,000m3 (2023: 597,000m3).