The stability that settled on the plywood market around this time last year looks set to continue and traders are generally satisfied with the level of business.

"We’re all fairly happy," one distributor told TTJ. "There’s plenty of product in the market and demand is quite strong."

The stronger market, for softwood product at least, is reflected in the fact that this year’s EU coniferous plywood duty-free quota was exhausted on June 19, just over three weeks ahead of last year’s expiry on July 12.

Another distributor agreed that there was "decent demand" from the merchant sector and for construction-grade product and the market was well balanced. Reassuringly, the improvement in demand was steady, suggesting that the "controlled growth" would continue.

"There’s product coming into the market and it’s moving through the system. I don’t think anyone has been tempted to over-buy," he said.

Prices were still firm and there was no talk of price cutting in the market, he added.

"I think it’s competitive but there are no signs that prices have fallen in the resale market," he said.

Prices for birch plywood are still very firm and lead times are out to as far as 14 weeks.

A UK representative for Baltic production said stocks in the UK were low and he had even received enquiries from people trying to place orders for 2015, although he added that he couldn’t confirm anything that far ahead.

His company had raised prices by 4.5% for the third quarter and wouldn’t confirm any new business for the fourth quarter "until we know where we’re going with prices and production".

Although the market was rarely ready to accept price increases he said they wouldn’t have much choice. "There’s not much plywood stock around so if you want stock you’re going to have to pay for it," he said. Birch plywood manufacturers were not making any greater profit but merely covering higher costs, he said. Log prices had risen and glue prices will be pushed up as Russia’s leading phenol manufacturer, Omsky- Kautchuk, has lost some capacity for the next 6-12 months following a fire in March.

Another distributor said margins in general were still tight but the market would have no choice but to accept price increases.

"One would hope that we can get to a point where we are increasing our margins because we seem to be very busy fools at the moment," he said. "There’s a lot of demand but there must be a lot of wood in the market because people are still not putting their prices up."

The freight rate hikes expected at the start of the second quarter didn’t materialise – remaining fairly stable at around US$2,000 per container or US$41.50/m³ – and contacts reported few issues with Brazilian and Malaysian supplies, although the latter had been affected to some extent by problems securing quality logs.

According to the Timber Trade Federation’s (TTF) statistics for the first quarter, all the leading hardwood supplying countries, except China, exported less volume to the UK compared with the first quarter of 2013.

China’s volumes rose by 35% but Malaysia’s fell 26%, Finland’s 16% and Uruguay’s by 34%. Overall, hardwood plywood imports were up 14% to 217,000m³.

One contact attributed the decline in Malaysia’s volumes to a combination of EUTR compliance, prices and quality issues.

"Unfortunately, in order to comply with the EUTR, Peninsular Malaysian producers are compelled to pay higher prices for lower quality logs, which is reflected in lower quality plywood at higher prices," he said.

Softwood Plywood

In terms of softwood plywood, the TTF statistics reveal that first-quarter imports were up 24.4% to 130,000m³, with the largest growth from Brazil and China.

However, one contact said there had been a "fairly significant change" in the Chinese market in recent months as many mills have caught up with outstanding orders and they are now reporting a shortage of orders from most of their traditional markets, including the UK and Continental Europe. Fortunately this coincides with many workers returning home to their local communities for the annual harvest and so production has been reduced in line with the reduced demand.

FOB prices for Chinese material have been stable but some mills are already hinting that if demand doesn’t improve they may consider lowering prices, TTJ was told.

"The number of unsolicited emails and contact requests via LinkedIn we receive from potential suppliers is usually a good indicator of market conditions and we are currently receiving more contact requests that we have for some time," a contact told TTJ.

However, he said trading with such companies was risky because many were oblivious to the EUTR and many that offered FSC-certified plywood were unable to back it up with genuine documentary evidence.

"Last week we were offered very cheap FSC plywood by an export trading company. When we asked for documents to confirm FSC compliance they said they could provide copy documents from a genuine FSC plywood producer but the plywood would be produced by another mill which was neither FSC certified nor used FSC-certified raw materials but all the crates would be marked with the genuine FSC plywood producer’s FSC logo and licence number," he said.

In addition, there were unconfirmed reports of genuine FSC plywood producers "buying invoices" for FSC-certified raw materials but instead buying local non-certified material. This enables them to produce low-cost ‘FSC’ stamped plywood while at the same time being able to provide invoices for their FSC auditors.

Another distributor agreed that there were still questions over the quality, marking and grading of some Chinese plywood but matters were investigated by the Timber Trade Federation.

BIRCH Plywood Ready to take a Bullet

Exterior birch plywood from Russian manufacturer SVEZA will play an important role at the Glasgow Commonwealth Games.

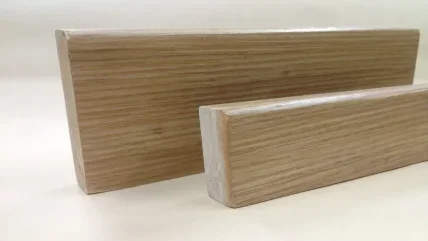

The 2440x1220mm FSC BB faced panels have been supplied for the temporary walls, baffles and canopies at the Barry Buddon Shooting Centre, near Carnoustie, on the east coast, and the product also clads the steel-framed venue. The main contractor for the project is John Sisk and Sons and in total 212m³ was delivered to site by SVEZA’s UK official partner, MBM Forest Products.

"The multi-ply birch plywood was used for both its strength, ease of use, appearance and as ballistic protection," said Tim Newton, project manager with specialist subcontractor Warbreck Engineering.

"It is designed and constructed to ensure that stray bullets are ‘caught’ and don’t accidentally exit the arena or ricochet in the direction of competitors or games staff."

The plywood was supplied in 9mm, 18mm, 24mm and 27mm thicknesses and used in a variety of configurations, depending on their position in the arena.

All seen faces are either painted white or grey, or clear varnished; non-seen but exposed faces are treated with a preserver and unexposed faces have been left untreated.

After the Games, which run from July 23 to August 3, the plywood will be "upcycled" for a variety of other uses within the local region.