TTJ: YOU RELAUNCHED YOUR MANIFESTO FOR THE COATINGS SECTOR DURING THE RUN-UP TO THE GENERAL ELECTION – CAN YOU RECAP ON WHY YOU DID THIS AND WHAT THE MANIFESTO COVERS?

David Park: We wanted to clarify our key asks for election candidates in the run up to the election. We have since updated it again to take account of the new government’s policies and actions, although the five key asks remain broadly the same: a clear and consistent regulatory framework; a longterm industrial strategy; a focus on skills and education, especially STEM subjects; more support for businesses for the transition to Net Zero; and greater support to improve trade opportunities both with the EU and globally.

TTJ: DO YOU HAVE ANY INDICATION YET HOW THE NEW GOVERNMENT’S POLICIES MIGHT AFFECT THE COATINGS SECTOR?

DP: The PM has been clear that he wants to see a closer relationship with the EU, resetting the somewhat tempestuous relationship the last government had in and after delivering Brexit. Before the election the now Chancellor said she wanted to see a bespoke deal arrived at with the EU on chemical regulation. In theory, if a deal on, for example, data-sharing on the European Chemicals Agency (ECHA) database can be struck, or an agreement to align with EU REACH in one form or another is struck, this might obviate the need for a standalone UK REACH system. Indeed, this may be why the government has delayed its response to the July consultation on the new Alternative Transitional Registration model (ATRm) until sometime in 2025, to see how things play out. However, this is conjecture at the moment.

We have also seen the new government’s first Budget, which was extremely disappointing from a business point of view as the revenue raising elements were aimed squarely at industry. More broadly, the Industrial Strategy Green Paper has been published and we have fed into that consultation process, making the point that coatings are essential to numerous other key manufacturing sectors across the economy. New laws on employment rights are in the pipeline and a new body, Skills England, will be set up to deliver reforms to training and apprenticeships. These latter changes could impact in a variety of ways, some negative, some positive – indeed some could deliver on our five asks – and we need to make our case to government in each instance.

TTJ: YOU HAVE WELCOMED THE GOVERNMENT’S AFOREMENTIONED INDUSTRIAL STRATEGY GREEN PAPER – WHY YOU ARE IN FAVOUR?

DP: It is important to have a focus on building UK industry from the very top of government. Moreover, that focus needs to last beyond one parliament. The Green Paper is trying to build a strategic approach for growing UK industry over the next decade. It is holistic in looking at a whole range of policy levers government might be able to pull to help industry grow.

While we welcome these steps forward, we are also clear a lot more work needs to be done to transform what was quite a bare Green Paper into a workable strategy, putting policy meat on the bones of the initial document. It was also surprising to see the strategy include financial services as a sector to be focused on, which seems to dilute the strategy away from ‘industry’ in its traditional sense. Finally, we need to be clear where the coatings sector fits into the bigger picture: as noted earlier, there are few parts of UK manufacturing that will succeed without a strong coatings sector and, for that matter, a strong domestic chemicals sector more widely.

TTJ: ASSUMING UK REACH IS STILL GOING AHEAD, HAVE THERE BEEN ANY REVISIONS/UPDATES IN THE LAST YEAR?

DP: The previous government carried out a consultation on a new Alternative Transition Registration model (ATRm) for UK REACH just before the General Election. A response was initially due around October 2024 but has been put back to 2025. This is because the new government wants to explore what might be possible in terms of greater co-operation and alignment as it discusses the future of the existing Trade and Co-operation Agreement (TCA) with the EU. Both the Chancellor and the PM referenced trying to obtain a ‘bespoke’ deal on chemicals, although we have little more detail as to what that might mean. Data sharing on chemicals? Some sort of associate membership of ECHA (although this was rejected in the initial negotiations for the TCA four years ago)? Greater alignment more generally? Something akin to the ‘Swiss’ model? We don’t know, but until there have been conversations about this new TCA approach (which the EU would have to agree to, of course) it seems likely the ATRm proposals will remain on the backburner.

TTJ: AMENDMENTS TO EU REACH WERE DELAYED UNTIL AFTER THE EUROPEAN ELECTIONS IN JUNE – CAN YOU UPDATE US ON THAT AND HOW THEY MIGHT IMPACT YOUR MEMBERS?

DP: The EU REACH revisions were indeed delayed and the Commission and Parliament are in talks about what this might now entail, as well as a timeline. Clearly this is something we are invested in in the UK as our members still have to manufacture to EU standards to be able to export there. Moreover, with the UK effectively still running REACH in the way it was on the day of Brexit, any changes in the EU will mean greater divergence between the two regimes which, in turn, means it becomes harder and more costly to keep up with. We are grateful to colleagues in the European Council of the Paint, Printing Ink and Artists’ Colours Industry (CEPE) for helping us and our members stay up to date with changes and we will always look to reciprocate on that information exchange in terms of changes happening in the UK.

TTJ: IS THE UK STILL A NET EXPORTER OF PAINT?

DP: Yes! Although the total has dropped a little in recent years, the UK coatings sector – paint, coatings, inks and wallcoverings – remains a net-exporter, to the tune of nearly a billion pounds a year.

TTJ: RAW MATERIAL PRICES STARTED TO DROP TOWARDS THE END OF 2023 – DID THAT CONTINUE INTO 2024?

DP: There was a steady drop back in raw material prices at the start of the year but this seems to have tailed off towards the end of 2024. Overall, it looks as though prices have stabilised but they still remain much higher – as much as 20% in some cases – compared to about a year to 18 months ago. The good news is there don’t seem to be bigger increases on the immediate horizon, although any geo-political changes in 2025 always run the risk of kick-starting more problems.

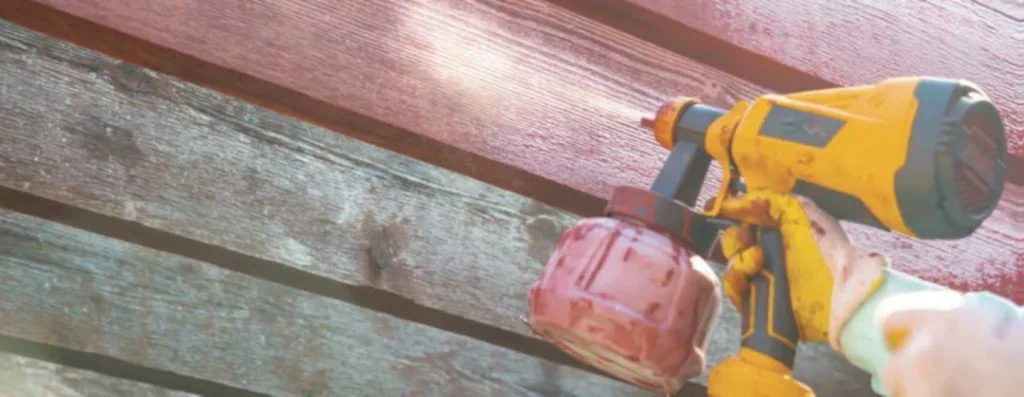

TTJ: HOW HAS THE MARKET BEEN FOR WOOD COATINGS MANUFACTURERS THIS YEAR?

DP: 2024 was largely flat in terms of sales from manufacturers into the supply chain. This suggests demand from consumers has also been flat – a trend we also see in decorative paint, and in industrial coatings.

The main trend we have seen in 2024 in woodcare is the shift from selling product through traditional DIY retailers into trade retailers like decorator’s centres. However, DIY still makes up the bulk of sales. We hope consumer confidence will pick up in 2025.

TTJ: WHAT IS THE LATEST NEWS ON BCF’S NET ZERO BY 2050 AND ON THE NET ZERO ROADMAP, WHICH YOU LAUNCHED THIS TIME LAST YEAR?

DP: We are in the process of planning an update to the 2023 Net Zero Roadmap. This will include a new data-collection process from members so we can measure progress made in carbon emission reductions over the past couple of years. This is a big undertaking for us and our members and will take some time to complete.

We will also look to update other aspects of the roadmap, including adding case studies where members and companies from similar sectors have done well and links to government support and resources that could help companies make more progress in future. That will probably be published towards the end of next year.

Before that we are hosting what is now our annual Net Zero seminar in March 2025, focusing on scope 3 emissions.

TTJ: WHERE DO YOU THINK THE CHALLENGES AND OPPORTUNITIES WILL COME FROM IN 2025?

DP: Any more geo-political shocks – military actions, tariff wars etc – will be the biggest source of challenges. They are also out of our control.

In terms of opportunities, the new UK government is promising increased expenditure on infrastructure and housing, which should create scope for members to sell their products.

Likewise, the continued drive for Net Zero and more sustainable products will generate opportunities for members who can come up with effective and more environmentally-friendly products to meet the growing demand from all sorts of different sectors.